The Netherlands tech ecosystem has lost momentum.

Let’s look at some alarming data to educate policy makers and the government how to measure and benchmark tech ecosystems.

Measuring nr of startups or total VC funding, is an oversimplified approach to measure about the overall performance and competitiveness of a tech ecosystem.

I’ll highlight core insight from Dealroom’s Global Tech Ecosystem Index 2025. All transparent data to benchmark 288 tech ecosystems and educate policy makers.

btw…

I've been writing and educating policymakers about tech ecosystems for more than 15+ years. From my time in London, Berlin and Amsterdam. Helping both TechNation, StartupDelta, Startupbootcamp, StartupAmsterdam, or building Growth Tribe and growing the Edtech ecosystem in Europe.

See my tech.eu Tech Ecosystem tour with Robin Wauters back in 2015.

Or read my blog post about Europe’s decline in 2023, one year before Mario Draghi wrote about Europe’s competitiveness.

Or learn about the difference between Finite vs Infinite games as tech ecosystem building.

Or learn about the 5 opinionated groups driving debate on Europe’s competitiveness & tech ecosystems on social media.

Or understand the difference between Hope vs Optimism.

See all my Europe & Tech Ecosystems articles here: https://petervansabben.substack.com/t/europe-and-tech-ecosystems

First insight: Enterprise Value Growth (EV Growth)

The Enterprise Value (EV) of an ecosystem is the combined valuation of all startups within it.

Enterprise Value Growth (EV Growth) is the change in that combined value over time, a crucial metric for tracking the overall growth of a tech ecosystem.

And here’s the shocker for the Netherlands.

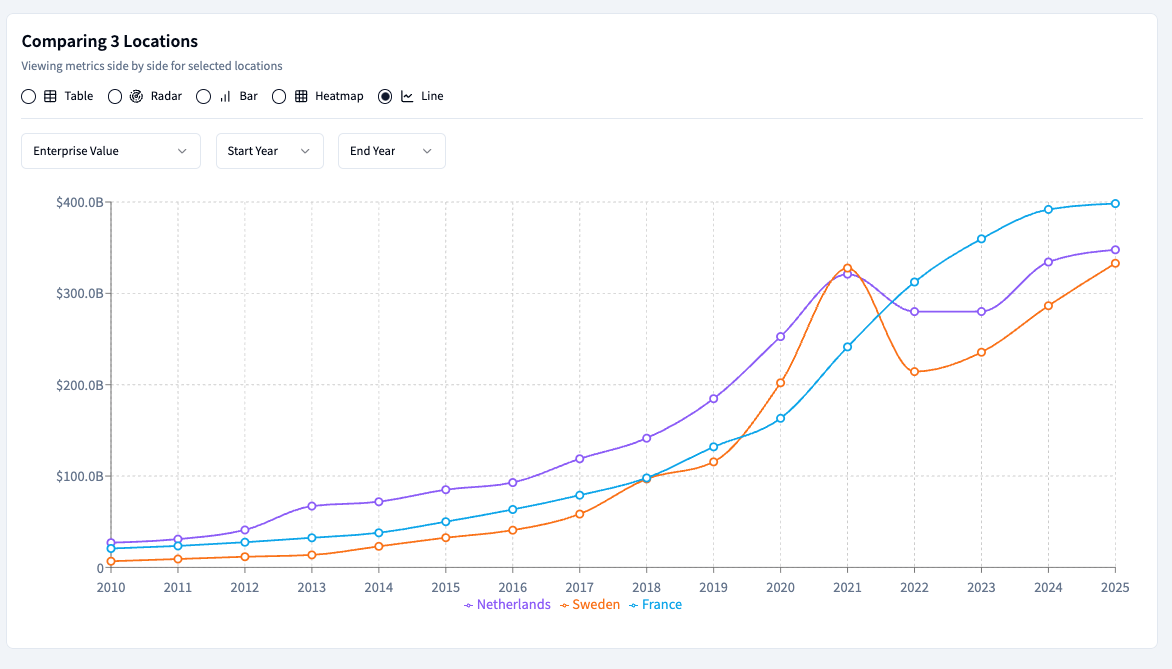

The Netherlands has the lowest EV Growth in Europe, just 2.8x from 2017 to 2024 (among ecosystems with a minimum of €20B in EV). It’s on the 19th place.

For comparison:

Germany: 3.7x

UK: 3.8x

Sweden 4.9x

France: 5.0x

If the large USA with impressive: 5.9x

Even Russia 3.0x is growing faster than the Netherlands.

Here is another line graph look if you compare Netherlands (purple line) with France (blue line) and Sweden (orange line), who are clearly showing impressive EV Growth in the last few years, and the Netherlands stagnating from 2021.

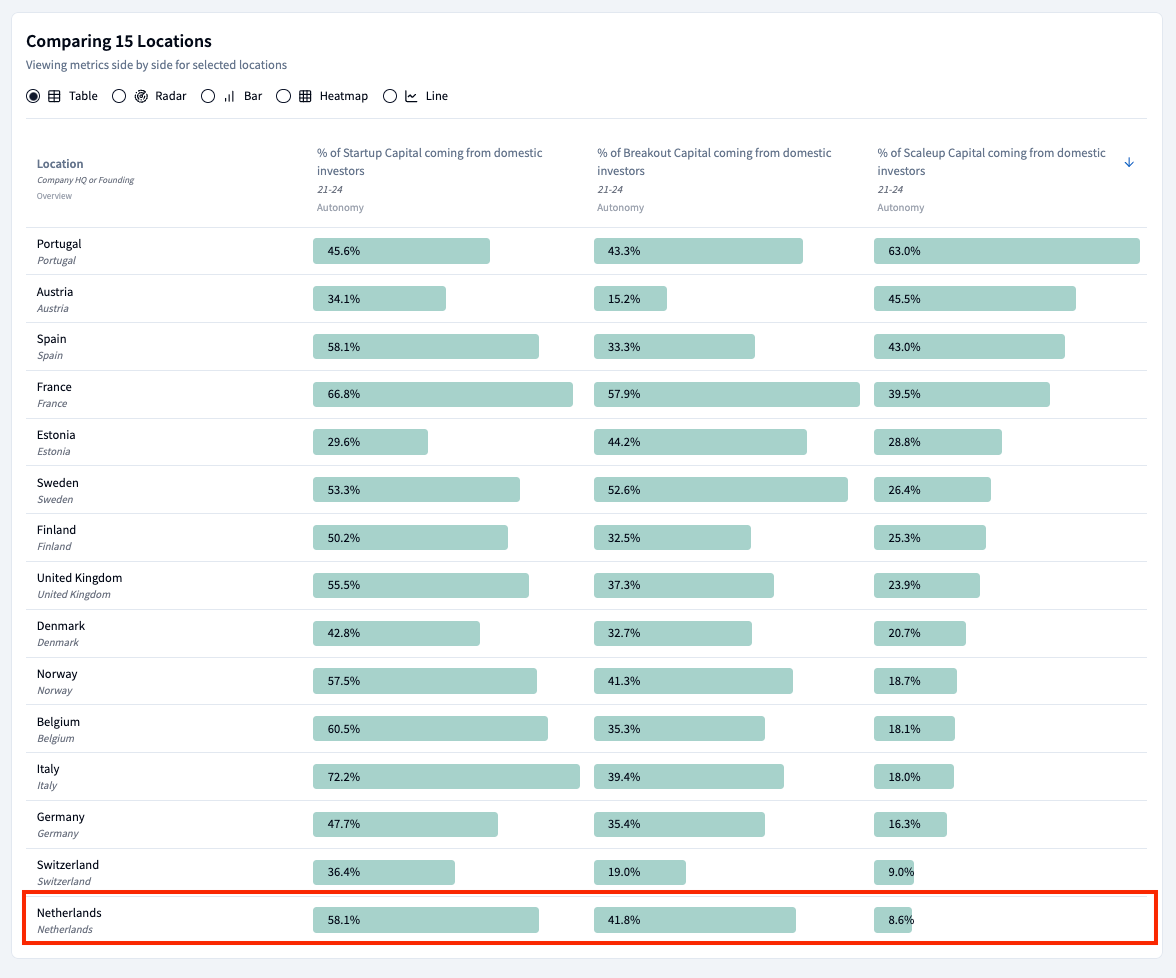

Second Insight: Percentage of Scaleup Capital Coming from Domestic Investors

Let’s talk about where scaleup capital is coming from.

We define three funding stages:

Startup stage: Companies with under $15M in total funding

Breakout stage: Companies with $15M–$100M in total funding

Scaleup stage: Companies with over $100M in total funding

The scaleup stage is less risky, these are companies raising large rounds ($100M+), often on track to become unicorns or market leaders.

This stage is crucial for enabling society to participate in value creation.

Think pension funds or government-backed capital being deployed into growth-stage VC funds.

But this isn’t happening in the Netherlands:

Only 8.6% of all scaleup capital in the Netherlands comes from domestic investors, far below the European top-10 average of 26%.

And this has nothing to do with market size. France is at 39.5%, and even Sweden reaches 26.4%. The Netherlands has large pension funds, but we’ve failed to convince leaders to invest in the scaleup stage. This is a huge problem.

It means the Netherlands lacks sufficient domestic growth capital.

More importantly: we, as a tech ecosystem community, are failing to ensure that society benefits from the success of its startups.

The value creation is happening, but it’s going abroad.

Question: I don’t know what the ideal percentage should be at this stage, but somewhere around 50% seems reasonable if you want to stay competitive, strengthen your economy’s earning capacity, and safeguard social well-being.

More about setting a goal about scaleup capital here: https://x.com/sabben/status/1916864732947943728

Further more: Jeroen Dijsselbloem, the mayor of the city Eindhoven, raising the point about the urgency of a national investment bank to invest in scaleup and growth capital for tech companies:

Third Insight: Amsterdam’s Lack of Academic Alumni & University Spinouts

Let’s zoom in on Amsterdam, which accounts for more than 75% of the entire Dutch tech ecosystem.

Amsterdam in a global context (out of 288 cities):

#21 in Global Champions

#16 in Density Leaders

Within Europe:

#5 in Global Champions, behind Paris, London, Stockholm, and Munich.

#7 in Density Leaders, behind Cambridge (UK), Munich, Oxford, Stockholm, London, and Copenhagen.

But one clear insight stands out: Amsterdam ranks lowest among these top 8 European cities when it comes to academic indicators. Specifically, it lags in university spinouts and alumni-founded startups raising between $1M and $100M.

This again highlights the broader issue: the Netherlands lacks sufficient scaleup capital.

Take Munich, for example. It’s extremely strong in this area, with 125 alumni-founded scaleups, companies that have raised $100M or more. In contrast, Amsterdam has only 62.

Furthermore, Let’s Look at AI Hubs as a Tech Ecosystem 🤖

When we examine the top global 20 hubs in AI, both in terms of Global Champions (scale) and Density Leaders (per capita), there is no Dutch hub in either list.

In AI, the Netherlands no longer plays in the first league. We're in the second division now.

The leading European Global Champion hubs in AI are: Paris, London, Cambridge, Munich, Copenhagen, and Stockholm.

And among the Density Leaders, we also see: Zurich, Tallinn, and Helsinki. Again, no Dutch hub appears in these rankings.

From an European perspective, Amsterdam (and the Netherlands) ranks only 8th as an AI tech ecosystem hub, behind Paris, London, Cambridge, Munich, Copenhagen, Stockholm, and Zurich.

Additionally, The data shows the same story when we look at Top Hubs in Deep tech. No Dutch city in the global top 20 for global champions or density leaders.

If we look at the sector strength and weaknesses from Amsterdam we see the same overview. Amsterdam performs well in Food & Argritech, Fintech, Climate tech and Energy. Unfortunately Amsterdam is performing poorly in new upcoming sectors like AI, of Life Science, Deeptech or even Robotics.

What Could We Do?

First, we must recognise that the Dutch tech ecosystem faces a serious, structural problem, both for lack of scaleup capital, failing leadership who couldn’t bring necessary change, or focused on the wrong priorities, or negative entrepreneurial/tech culture sentiment under the broader society and inside the media.

Not strange we lost momentum years ago.

How to fix this?

Leadership: The Netherlands, and Amsterdam, urgently needs a new generation of digital-native, young leadership to drive meaningful change. This leadership vacuum has persisted for over 20 years.

Look at examples of Paris with Macron taking tech serieus for years or in Sweden with Ulf Kristersson launching AI Reform plans. Something we don’t see this big and impactful in the Netherlands at the government level.

Culture: We need to move beyond the culture of ‘polderen’, excessive consensus-seeking, fragmentation, and avoidance of tough decisions. That approach doesn’t work in a fast-changing, digital, AI-driven world.

Relearn again to have difficult conversations. Unlearn ‘old believes and old mental models, be open for disruption. Learn to stop initiatives without any impact. Listen to intellectual skeptics or the brave optimists pushing for change.

Vision: Make it exciting and prestigious for young digital talent to join the government… again. Working on innovation projects that tackle deep broken systems, cultural, and capability issues from within or at the edges to stay agile and truly bring innovation.

Example: Herprogrammeer de overheid.

Actionable steps what needs to happen:

Welcome and support a major AI hub to consolidate talent and ambition. Have something meaningful that inspire people.

Empower real builders, tech entrepreneurs to lead and execute a new "Deltaplan for AI." No fixers or consultants, but true builders = entrepreneurs and builders/hackers/coders = people who can build stuff.

Convince pension funds and government capital to back growth-stage VC funds to address the chronic lack of scaleup capital + set a goal % of domestic growth capital that needs to come from domestic investors, to participate in the value creation.

Reform labor laws to make it easier to attract and retain top international AI talent. Goal attract international talent in max two weeks vs currently more than 6 months.

Incentives matter. Entrepreneurial incentives are declining (university tech transfer, international expansion, labor rules, exit landscape). This should change. Improve startup incentives and tax benefits attractive to build and stay in the Netherlands.

Further more:

Learn more about the Global Tech Ecosystem Index 2025:

And feature demo: how to explore tech ecosystem data on Dealroom’s live and interactive dashboard:

Finally, download the Global Tech Ecosystem Index report here:

Download report: https://dealroom.co/tech-ecosystem-index-2025